is interest paid on new car loan tax deductible

If you are in a lower tax bracket you will not be able to take advantage of. The standard mileage rate already.

Are Personal Loans Tax Deductible Common Faqs

Typically deducting car loan interest is not allowed.

. But there is one exception to this rule. Interest paid on personal loans is not tax. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

The question of what types of interest payments are tax deductible used to be a simple one but since 1986 the law governing tax deductible interest payments has become very complicated. This is because you cant deduct personal expenses on your income taxes Babener says. If you use your car for business purposes you may be allowed to partially deduct car loan interest as.

In most cases personal loans do not have tax-deductible interest. Car loan interest is tax deductible if its a business vehicle. Tax benefits on Car Loans.

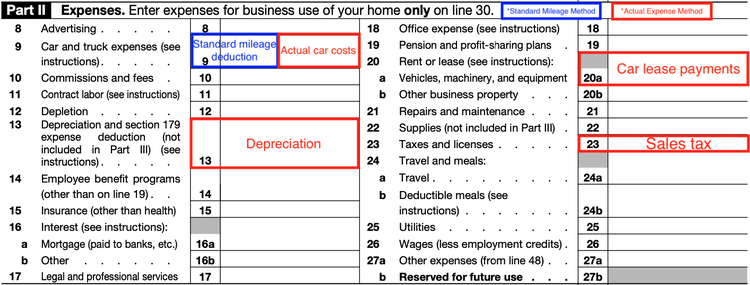

Interest paid on a vehicle loan is not deductible on a tax return if for a personal vehicle not used in a business. The interest you pay on student loans and mortgage loans is tax-deductible. You cannot deduct the actual car operating costs if you choose the standard mileage rate.

For 2021 the total limit is 1040000 After the Section 179 spending cap is. So if you use the. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB.

Reporting the interest from these loans as a tax deduction is fairly straightforward. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized.

Thus you are not eligible for any. The tax deduction for interest on a car loan is only available for those in the 25 or higher tax bracket. She borrowed money to buy the vehicle and the interest she paid in her 2021.

May 10 2018. Section 179 allows you to deduct a 100 of the cost of qualifying items up to a certain limit. The personal portion of the interest will not be deductible.

Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. The interest on a personal loan normally is not tax-deductible because the Internal Revenue Service treats such interest as personal interest. Experts agree that auto loan interest charges arent inherently deductible.

However for commercial car vehicle and. The benefit Section 80EEB can be claimed by individuals only. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest.

10 Interest on Car Loan 10 of Rs. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. On January 1 2021 she bought a new passenger vehicle that she uses for both personal and business use.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return.

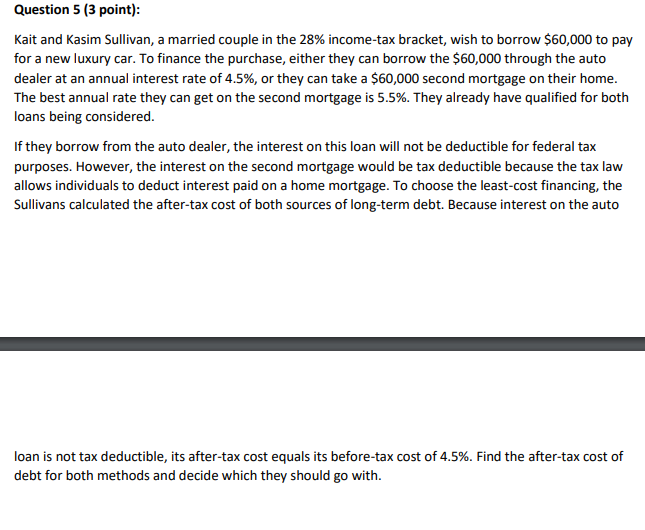

Solved Question 5 3 Point Kait And Kasim Sullivan A Chegg Com

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

Can Interest Paid On Car Loans Be Deducted Jerry

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Mortgage Interest Deduction A Guide Rocket Mortgage

Car Leasing And Taxes Points To Ponder Credit Karma

25 Small Business Tax Deduction You Should Know In 2022

Car Loans For Teens What You Need To Know Credit Karma

Can I Write Off My Car Payment

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How To Take A Tax Deduction For The Business Use Of Your Car

Are Car Repairs Tax Deductible H R Block

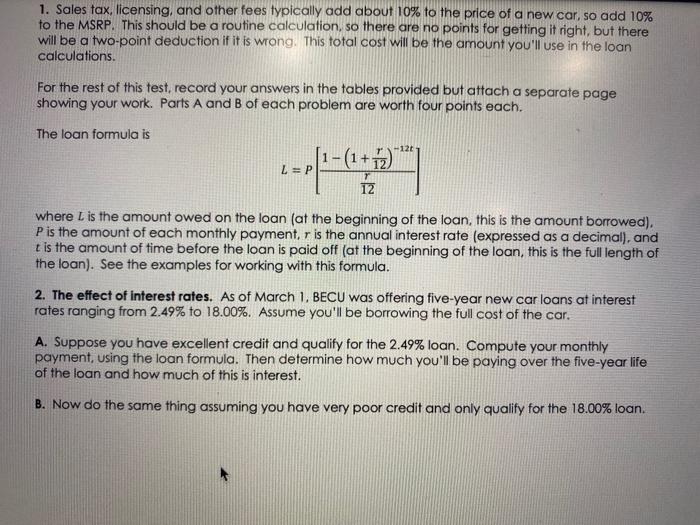

Solved 1 Sales Tax Licensing And Other Fees Typically Add Chegg Com

How To Write Off Vehicle Payments As A Business Expense

How To Calculate Auto Loan Payments With Pictures Wikihow

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate