pay indiana business taxes online

Cookies are required to use this site. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME.

Tax Claim Indiana County Pennsylvania

INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more.

. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales. Business taxes are a fact of life and your LLC will need to pay a variety of taxes to both the state and federal governments. Indiana businesses have to pay taxes at the state and federal levels.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Pay online quickly and easily using your. Property Tax Payment Options.

Estimated tax installment payments may. Talk to a 1-800Accountant Small Business Tax expert. Estimated tax installment payment due dates.

Ad Manage All Your Business Expenses In One Place With QuickBooks. Your business may be required to file information returns to report. Dont worry its pretty painless.

Pay Your Property Taxes. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Prepare to file and pay your Indiana business taxes You can file and pay with the.

Explore The 1 Accounting Software For Small Businesses. If the business cannot locate. Get the tax answers you need.

Indiana Business Taxes for LLCs. Prepare to file and pay your Indiana business taxes. Track Everything In One Place.

Set up necessary business tax accounts List what the business does List which taxes will be collected and paid Complete an application for each. Business Tax Application form BT-1. Your browser appears to have cookies disabled.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. If the due date falls on a national or state holiday Saturday or Sunday then payment should be made online or postmarked by the next business day. Talk to a 1-800Accountant Small Business Tax expert.

If you have an account or would like to create one or if you. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. The self-employment tax is a social security and Medicare tax for individuals who work for themselves.

After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business. Ad Manage All Your Business Expenses In One Place With QuickBooks. Ad Find out what tax credits you might qualify for and other tax savings opportunities.

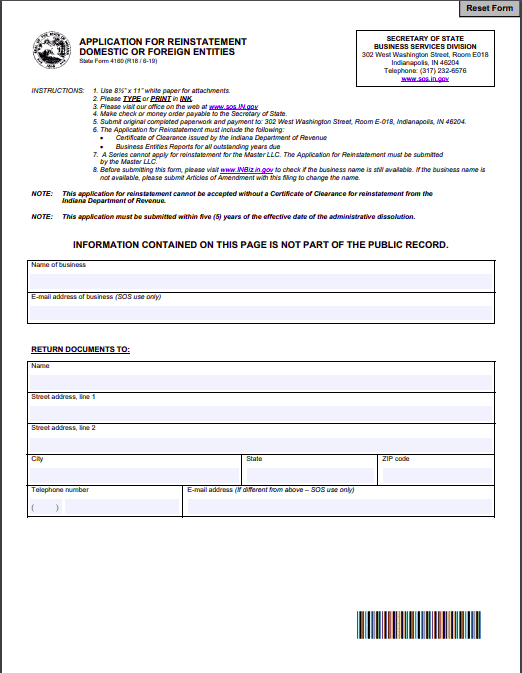

After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business. Track Everything In One Place. After you register your business with the Secretary of States office its time to register with the Department of Revenue for tax purposes.

Explore The 1 Accounting Software For Small Businesses. Any employees will also need to. Everything is included Prior Year filing IRS e-file and more.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. Ad Prepare and file 2019 prior year taxes for Indiana state 1799 and federal Free.

Credit Card 25 per transaction 150 minimum Debit Card 395 per transaction eCheck no service fee. If the due date falls on a national or state holiday Saturday or Sunday then payments. If a business does not pay its tax liability the RRMC will expire.

15 of the following year. Get the benefit of tax research and calculation experts with Avalara AvaTax software. Get the tax answers you need.

You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Indiana Llc How To Start An Llc In Indiana In 12 Steps 2022

Do I Have To File State Taxes H R Block

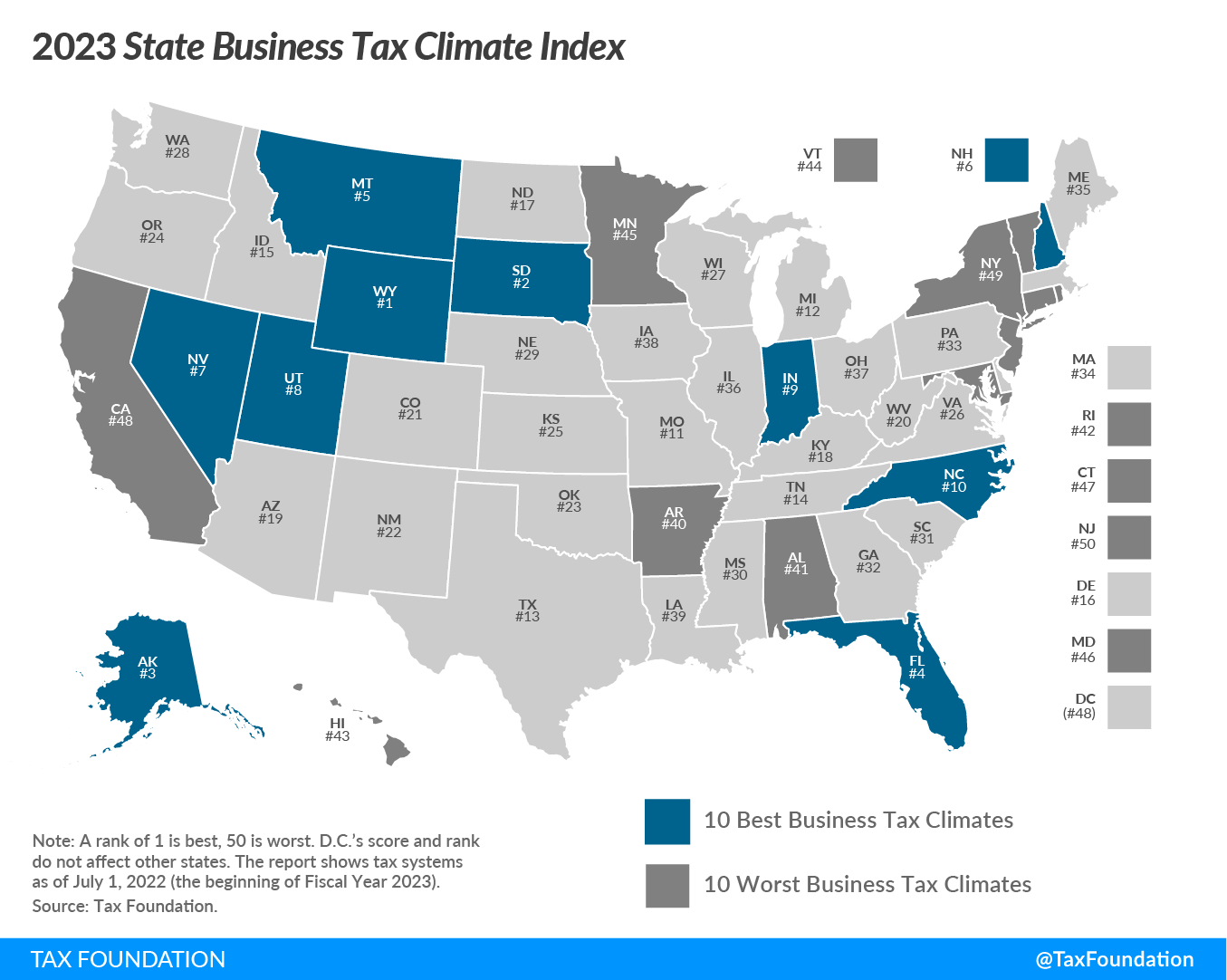

Business Income Taxes In Indiana Who Pays

State Tax Filing Software H R Block

Business Personal Property Tax How To Maximize Your Efficiency

Bonus 125 Refund Coming To Indiana Taxpayers But Not Quite Yet Wthr Com

Pennsylvania Pa Tax Forms H R Block

Dor Completing An Indiana Tax Return

Business Income Taxes In Indiana Who Pays

Indiana U S Small Business Administration

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Free Guide To Reinstate Or Revive An Indiana Limited Liability Company

Dor Indiana Department Of Revenue

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor